Eveready

Member-

Posts

356 -

Joined

-

Last visited

Everything posted by Eveready

-

Such bollocks as isn't women's team's investment excluded from PSR calculations but somehow the sale of the asset is allowable? Before any ruling is made, where the PL will bring in different rules, we should create a new subsidiary for the women's team - completely owned by NUFC Ltd. Pump £2bn cash as equity into the women's team entity then sell it to the NUFC Ltd parent company (PZ Newco*) for £2bn. Can't argue with our valuation if they have that much cash. *PZ Newco owns 100% of NUFC Ltd and itself is owned by PIF (85%) and RB (15%).

-

Looks like a regular job advert 'email now to register your interest'

-

Hall shouldn't make much difference. Was reported as £4m loan fee and £24m to make permanent. 2023-24 season loan cost: £4m recognised all in year Amortisation cost/year: £24m/5 years = £4.8m recognised/year for the next 5 years Should only be an annual increase of £800k cost in our accounts this year if the reported loan & permanent fee were correct.

-

We have the Adidas revenue in this coming season and Eales mentioned a few others in the pipeline to be finalised in the coming months. No idea how far that goes to offset the lack of CL revenue this season though.

-

Ah yes, Argentina. The country where all the citizens definitely look native...

-

Don't understand why Emery isn't top of the list for all international teams. You'd think a tournament specialist is exactly what they'd be after.

-

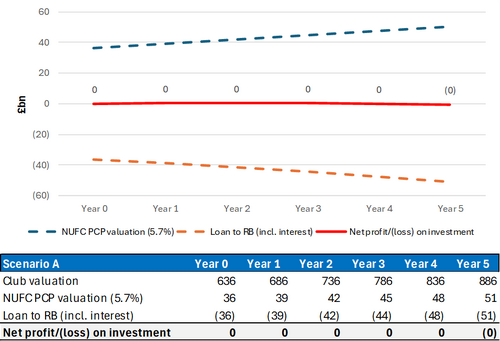

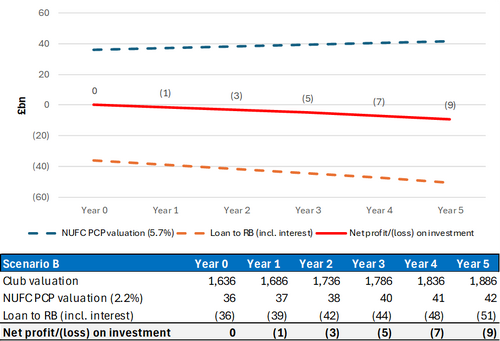

I'm going to attempt to explain why it was never viable for PCP to keep their stake with significant infrastructure investment. PCP owned their 6% (after dilutions), however they borrowed the money from RB to purchase this at 7% annual interest, which has not been repaid. Staveley had to borrow money from the club to pay for legal fees unrelated to NUFC, strongly indicating that that she has liquidity issues. Below I have set out 2 scenario's, neither are entirely realistic as they don't include any additional investment transfers/wages. However, they are illustrative enough. PCP has probably just about managed to keep up with interest to RB with the increased valuation of the club based on organic growth (excluding the addition investment in the playing squad). However, if a large infrastructure investment is made, their share will reduce significantly but the valuation of the club based on organic growth will likely continue as an absolute £ value. This would mean that if the clubs value organically grew £50m in a year, PCP would recognise £2.85m profit at their 5.7% share. However, if a £1bn infrastructure investment was made, they would only recognise £1.1m profit at an equity share of 2.2%. However, the interest would continue to accrue at the same 7% per annum. Assumptions: Current NUFC valuation: £636m (source: Forbes) PCP equity pre-disposal: 5.7% (source: widely reported) Current value of loan from RB: £36m (this is understated, but it's more about direction of travel so it's sufficient for illustration) Loan at 7% interest (source: PCP/Cantervale's Companies House filings) £1bn infrastructure investment in Scenario B (roughly the cost of Spurs new stadium) The club's value increases organically by £50m/year (current valuation of £636m, less £305m initial purchase value, less £206m additional cash injections = £125m increase in valuation before cash injections. £125m/3 years of ownership = c.£42m/year. Rounded up to £50m/year) The valuation of the additional infrastructure remains constant at £1bn Scenario A - No further investment. Organic growth only Scenario B - £1bn infrastructure investment. Organic growth of footballing operations The longer they stay, the more precarious their position would become. I've put this together in about 10 minutes and I'm currently too lazy on a Friday afternoon to check so apologies for any errors, but directionally should be sound.

-

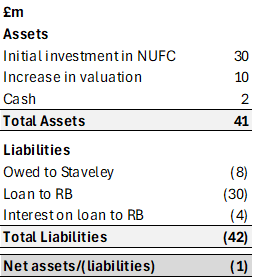

Never mind not having the money to invest further, PCP don't have the money to keep the 6% they had. PCP's latest accounts from Companies House (to Jan-22, they've extended their accounting period and no filings since) show that NUFC looks to be the only investment in their portfolio. Simplifying their balance sheet it looks something like this: She simply doesn't have the capital to pay off RB to even secure the previous 6% stake she had in the club previously. With significant infrastructure investment likely on the horizon, the club valuation would be unlikely to increase at the same rate as investment until the completion of the infrastructure into a useable asset. This means that the interest on the loan would likely increase faster than than the increase in the valuation of the club (especially as her shares dilute) and would likely be underwater in the investment putting her in a very precarious financial position.

-

Because commercial deals and sponsorships do count as revenue & income, as you're selling a product or service. However, investors are also able to pump direct cash into the business, which will sit on the balance sheet and not impact the P&L in any way. In short, if we sell a product/service (ie. sponsorship) we will recognise the cash received as revenue in our P&L account. However, if it's purely cash invested into the business, there is no associated product so it's not revenue and has no impact on the P&L.

-

Investment isn't income/revenue from an accounting standpoint, they are allowed to plough in as much money as they wish as I understand. It's how/when the money is spent which is important for the accounting & PSR side.

-

Can't say I'm massively surprised. Looks like she borrowed the £30m to purchase her stake in the club from the Reuben brothers, which hasn't been repaid and is accruing interest She has a c.£3m judgement to settle from a court case unrelated to NUFC She's clearly having cash flow issues as she had to borrow money from the club to pay her legal fees during aforementioned court case (reported in the Telegraph) Any significant capital investment for new stadium, stadium expansion and new training ground would dilute her too much for it to be worth remaining the face of the club.

-

The one positive to look at this from is that although we think we might have poor decisions against us because we see Germany as our biggest football rivals, they don't really care all that much about us. It's our opponents tomorrow they see as their biggest football rivals.

-

Deploying capital with our ownership might not be the easiest depending on how they're all aligned. Staveley is the face of the club from a corporate standpoint and I'm sure she wants to maintain a sizeable stake in the club. But from what I've read, PCP's share has reduced to 6%, with the Reuben brothers increasing to 14% and PIF remaining at 80%. This could indicate that Staveley doesn't currently have the liquid assets available to contribute to additional investment and therefore has to dilute. Forbes currently has the club valued at £636m - https://www.forbes.com/teams/newcastle-united/ Tottenham's stadium cost c.£1bn to build. If we built a stadium that cost the same as Tottenham's (haven't read into the detail but assuming no land cost as it was built on the WHL site) without additional investment from PCP, their share would drop to 2%. The Reuben brothers' would also need to find £140m to invest if they don't want to be diluted. Presumably PIF hold all the cards at board level and could force it through if they wanted to, but there are considerations, like keeping the local businessmen (Reuben brothers) happy and ensuring Staveley has a large enough stake in the club if they want her to continue as the face of the club. Multiple owners usually makes these decisions take a lot longer.

-

So they want to ban Paqueta for life for match fixing because he bet against himself. Yet that fucker really only got a 6 month ban? I understand it's different governing bodies but fuck me, that's mental he's still allowed to work in football at all.

-

I'm assuming that we did need those sales for PSR reasons. From a planning sense it would be easier to manage more consistent losses over the 3 year period than big peaks and troughs in annual results.

-

Somehow still looks less ridiculous than Depay's headband.

-

I read £4m loan fee, £24m to make the deal permanent. Shouldn’t be much difference between the loan fee recognised last year and the annual amortisation cost recognised moving forward.

-

Don't get how you can be shielding the ball when you're 10 metres away from it.

-

I'm hoping that the Ashworth to Man Utd being reported as 'agreement reached' as opposed to 'deal completed/Ashworth joins Man Utd' means that this transaction hasn't been completed. Should result in the profit from the sale being recognised in the 24/25 accounts and mean it wasn't required for the June PSR deadline of the 23/24 accounts.

-

Don't think this will eat much into our spending budget this summer. As I understand we paid a £4m loan fee which would've all been recognised last year and the fee for the transfer is £24m (£4.8m amortisation cost recognised/year for 5 years). So this will only increase our cost base by £0.8m moving forward. Unless I the figures I read on the split between the loan fee and transfer fee are incorrect.

-

My point was solely in response to the comment that we shouldn't have bought Barnes last summer so we could keep Minteh this summer. If we bought a different player last summer that would be a moot point to start with. I'm not saying we shouldn't have bought Barnes, just that even if we didn't we would likely still need to raise c.20m by the end of June.

-

If we believe the £30m gap figure then this still wouldn't have helped. Capology have Barnes' annual wage at £4m and £7.6m of his £38m fee would've been amortised over the last year. He almost certainly won us 3 points when he came off the bench and scored a brace against West Ham whilst 3-1 down, without which we would've finished below Man Utd and would've cost us £3m in PL finishing position cash. Very rough figures but: £4m +£7.6m -£3m =£8.6m total savings in this financial period

-

Is anyone really talking him down that much? He looks a great prospect, but from a league which is notorious for goal scorers not being able to transition to the Premier League. It's looking increasingly likely (as presumably we won't sell Bruno or Isak) that it's either sell Minteh or take a points deduction. Without securing CL next year then we would expect to lose Isak & Bruno in the summer. I personally don't think taking the risk of losing them next summer is worth keeping a very promising, but unproven prospect for. The race for 4th is usually very close - we don't need the added pressure of a points deduction.

-

Presumably neither Dortmund or Liverpool value him at £40m. Seeing as they know he's available for that price for next ~50 hours and there's not reports of them putting a bid in.

-

Hopefully we're looking at doing all the smartarse shit we can. Not sure if there's any precedent, but we could try argue Tonali's fee shouldn't be amortised whilst he's under a ban as he's not a useable asset, which could save us close to £10m this year. Also, when selling, as cash isn't an issue, could we sell the player but have the entire payment due after 5 years? Assuming 3% inflation - a £40m sale at the start of year 1, which could be banked as profit, would only be an equivalent £34.5m payment by the end of year 5 after adjusting for inflation. Helps us on FFP and also helps the buying club with cash.